by James Corbett

by James Corbett

corbettreport.com

October 5, 2016

You have no doubt heard by now about the precarious situation that Deutsche Bank finds itself in, including the impending US government fine for selling faulty mortgage-backed securities in the run up to the financial crisis. The lamestream media is busy running stories about German bailout rumors, and bank’s uncanny ability to not quite die…yet. But in case anyone is tempted to draw comparisons with the 2008 financial crisis, rest assured that the failure of Deutsche Bank would be no “Lehman Bros. moment.” It would be incomparably worse.

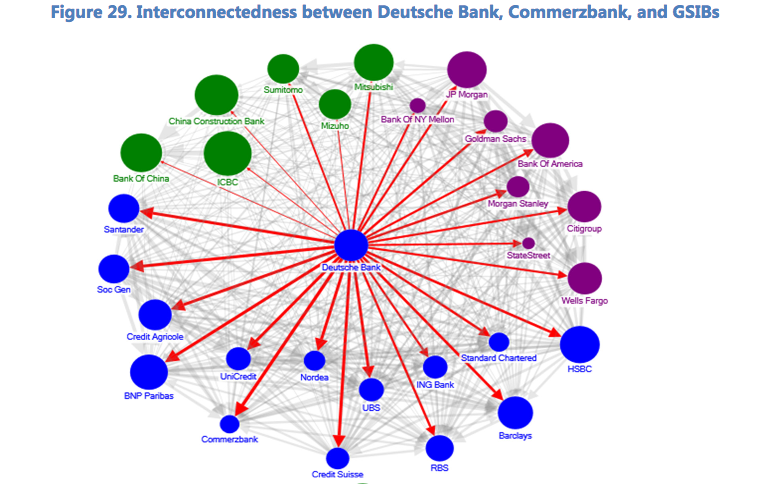

Deutsche Bank is not just one of the largest banking and financial services companies in the world (although it is that). It is also one of the most inter-connected banks in the world. As the IMF helpfully pointed out earlier this year:

“Deutsche Bank is also a major source of systemic risk in the global financial system. The net contribution to global systemic risk is captured by the difference between the outward spillover to the system from the bank and the inward spillover to the bank from the system based on forecast error variance decomposition. Deutsche Bank appears to the most important net contributor to systemic risks in the global banking system, followed by HSBC and Credit Suisse. Moreover, Deutsche Bank appears to be a key source of outward spillovers to all other G-SIBs as measured by bilateral linkages.”

And here is the handy dandy diagram they provided to demonstrate those “bilateral linkages” that could contribute to “outward spillovers” to the other “G-SIBs” (that’s “globally systemically important banks” to all of you not versed in Bankster-speak):

But more to the point, this doesn’t just mean that their CEOs play golf together every year or two. These linkages include derivatives counterparties. What this diagram is really showing us is that when/if Deutsche Bank goes under it will create a derivatives black hole that threatens to draw in most of the largest financial institutions in the world…each one of which would then create its own black hole of derivatives debt.

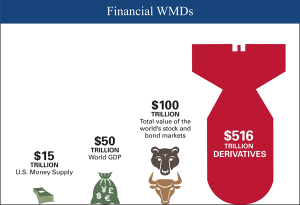

Now you’ll remember that derivatives are bets on the performance of some other thing, like an asset, index, interest rate, etc. Like any bet, it can happen between two or more people and things can get very messy when one of the people involved doesn’t have the money to pay up in the end. But derivatives can get even more wild, since the amounts in question can add up to trillions of notional dollars, i.e. money that does not actually change hands…unless everything falls apart and someone is left holding the bag.

So if all of that was done on the basis of AIG’s half-a-trillion or so in counterparty risk, what are we looking at with Deutsche Bank?

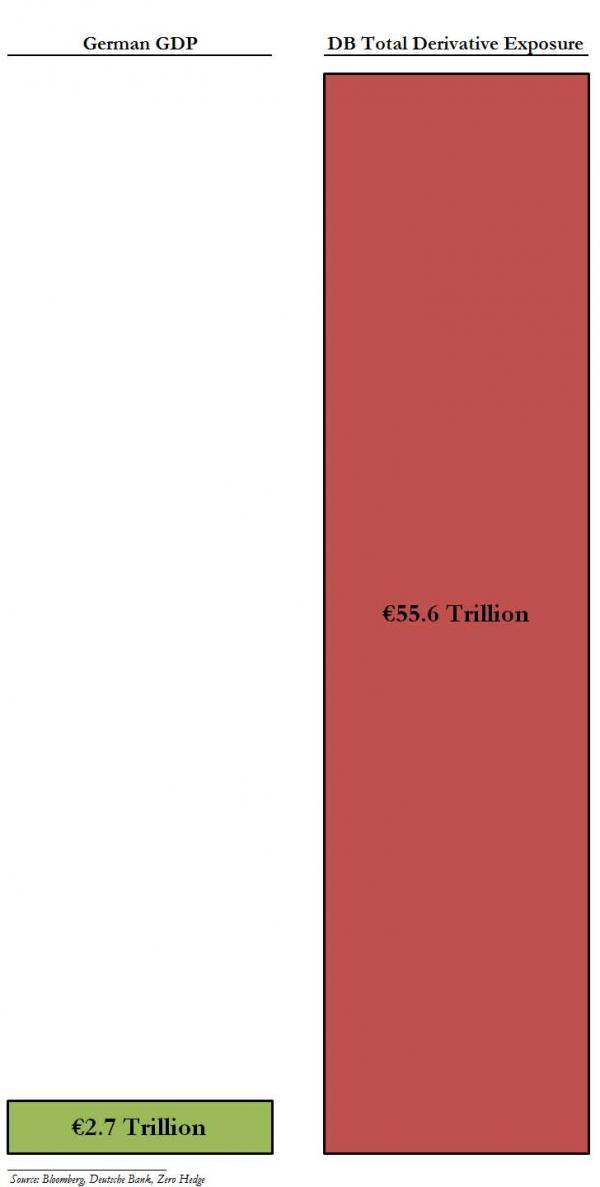

Well, in 2013 its notional derivative exposure was 55.6 trillion euros. Let’s put that in perspective with a graphic from ZeroHedge comparing DB’s derivative exposure to the Gross Domestic Product of Germany.

Does that look frightening? Well, don’t worry. Deutsche’s derivative black hole has been pared back to a much more modest 46 trillion or so euros, a mere 15 times German GDP.

Does that make you feel any better? I didn’t think so.

Well, maybe this will make you feel better: In the wake of the 2008 meltdown, the banksters put their heads together to come up with some new regulatory guidelines for containing the derivatives exposure mess. These changes were articulated by the G20 at the 2009 Pittsburgh conference. While the protesters outside were being abducted in broad daylight and being introduced to the LRAD, the banksters’ political puppets were busy hammering out the following:

“All standardized OTC derivative contracts should be traded on exchanges or electronic trading platforms, where appropriate, and cleared through central counterparties by end-2012 at the latest. OTC derivative contracts should be reported to trade repositories. Non-centrally cleared contracts should be subject to higher capital requirements.”

(Interestingly, this idea was first proposed in a white paper published by the Bank for International Settlements (yes, that Bank for International Settlements), then announced at the G20, then handed off to the Financial Stability Board (which I’ve discussed before) to insure compliance, and then adopted by the individual central banks that make up the BIS membership. And that in a nutshell is how global marching orders are given without the need for an explicit “global central bank” with authority over everyone.)

So theoretically this new regulatory regime, combined with the fact that many of Deutsche Bank’s derivatives will be hedged by other trades, will mean that we won’t be looking at a 46 trillion euro black hole if Deutsche goes under…

…Unless.

Unless the IMF, which went to great pains to single Deutsche Bank out as the most precarious bank in Europe, might have ulterior motives for destabilizing the existing financial order and bringing in one governed by their own soon-to-be global reserve instrument.

Unless the US government has its own reasons for pulling the rug out from under the ECB by imposing a fine that they know would cause Deutsche to go under.

Unless the ECB actually welcomes such an event (and the recalcitrance of Germany to bail the bank out) as an excuse to flex its muscle and intervene directly with a miracle bailout that “saves the world” in the nick of time.

But we all know such august institutions as these would never cause a crisis in order to benefit from it, would they?

And on a completely unrelated note, Deutsche Chief Executive John Cryan is in Washington this week to meet with US officials on the sidelines of the IMF’s annual meeting. Sleep tight, everyone!

Words fail me.

I think it is good to point out the different between gross and net exposure. The exposure of 55 trillion mentioned here is the gross exposure. Basically, a bank has both long and short positions and these cancel out. The net exposure is typically 0.1% of the gross exposure and is a more realistic measure of risk. See http://economics.stackexchange.com/questions/10649/why-hasnt-massive-derivatives-exposures-at-banks-already-led-to-disaster

A fair point, Frank. This is what I mean when I write “combined with the fact that many of Deutsche Bank’s derivatives will be hedged by other trades.” The problem here is that we don’t know what Deutsche’s net exposure is. The 0.1% figure in your comment doesn’t seem to source to anything at all, let alone anything specifically about Deutsche. But on the issue of Deutsche’s net vs. gross exposure, this article is relevant:

http://www.zerohedge.com/news/2014-04-28/elephant-room-deutsche-banks-75-trillion-derivatives-20-times-greater-german-gdp

Excerpt:

“And as we further explained both last year and every other time we have the displeasure of having to explain the reality of gross vs net, this accounting gimmick works in theory, however in practice the theory falls apart the second there is discontinuity in the collateral chain as we have shown repeatedly in the past (and certainly when shadow funding conduits freeze up), and not only does the €21.2 billion number promptly cease to represent anything real, but the netted derivative exposure even promptlier become the gross number, somewhere north of $75 trillion.”

Also relevant:

http://www.zerohedge.com/news/how-us-banks-are-lying-about-their-european-exposure-or-how-bilateral-netting-ends-bang-not-whi

Thanks for your reply James.

The 0.1% was sourced from “the OCC report per 31 Dec 2014 as well as the annual reports 4Q 2014 for each of the above-mentioned banks”:

Here is the image of a table of the gross and net exposures of several banks:

https://media.licdn.com/mpr/mpr/shrinknp_800_800/AAEAAQAAAAAAAAKZAAAAJDlkN2U0Mjk0LWEyMjEtNGE0Ni05N2YwLTc5NzU5YzEyOWEwYw.png

Dividing net by gross gives you 0.1%.

Frank, what you are saying is true to some extent until the music is playing and everybody is dancing.

Once music stops then we will see the depth of sinkhole.

But then legions of their lawyers will probably bent the rules, make new ones (effective retroactively), find creative interpretations, like they did in Greece case.

http://www.bullionbullscanada.com/index.php/commentary/international-commentary/24416-credit-default-swap-fraud-exposedconfirmed

Honestly, I find language such as “discontinuities in the colleteral chain” and “music playing… people dancing…” to distract from a very simple observation. Namely that the casino bank never has to pay for roulette bets on red and black combined (gross) because that outcome is impossible. Therefore the expsure that is illustrated by especially the bar chart is misleading.

I fully agree that the current financial system is rotten and heading for disaster. But credibility of the alt media should not be sacrificed to fire up the doom and gloom party.

Phreedomphile, you said:”…with a lot of related talk about wealth inequality and a return to communism and redistribution”.

Return to redistribution?

In fact, we have redistribution since the beginning of civilization. From slaves, serfs, workers to the upper castes. You can say that is/was according to habits, rules, laws but that still doesn’t change underlying reality.

Maybe this is hard to see and could depend to which caste you belong.

Corbett’s acumen on global finances is profound.

– GOLD –

Did anyone notice the declining Gold Price trend just prior to and following CorbettReport’s article on SDR?

Gold declining almost $100oz within weeks…

Chart – https://www.dailyfx.com/gold-price

Corbett Report –

“SDR World Order” https://www.corbettreport.com/sdr-world-order/

“The Most Important Story You Didn’t See This Week” https://www.corbettreport.com/the-most-important-story-you-didnt-see-this-week/

~~~~

– Oil Futures –

There are many mainstream articles about how the oil markets are rigged (and the vast amounts of “loaner & Investment Fund” Money into the energy sector).

Here is another recent example of derivatives on Oil Futures…

QUOTE

“… 123 future market barrels (of oil) were traded for every one barrel produced….”

https://finance.yahoo.com/news/why-oil-prices-rise-more-230000812.html

~~~~~

I can only laugh to stay off the weeping… we live in a controlled virtual world to benefit the elite in the real world.

— Oil – Recent News on Government rigging the reports —

Oct 7, 2016

OILPRICE.com

“The Billion Barrel Oil Swindle: 80% Of U.S. Oil Reserves Are Unaccounted-For”

http://oilprice.com/Energy/Crude-Oil/The-Billion-Barrel-Oil-Swindle-80-Of-US-Oil-Reserves-Are-Unaccounted-For.html

It is also interesting that these arbitrary “adjustments” to the oil reserves accounting method were introduced in 2001.

Could this be payback for Germany asking the US to give back Germany’s gold?

Could be. I would put to the same category VW CO2 case, BNP Paribas doing business with Iran, Apple tax case… But I think at the same time they would like that public see all these cases like fight between nation states, national economies. They have to support prevailing paradigm of nation states. Shortly, it is fight and also show for gullible people.

At the same time they are working hard on higher levels like BIS to sustain the present rotten system and transform it to some kind of global nightmare.

Oct 17,2016 – Reuters – SILVER PRICE FIXING

“Deutsche Bank to pay $38 million in U.S. silver price-fixing case”

http://www.reuters.com/article/us-deutsche-bank-settlement-silver-idUSKBN12H2HB

Deutsche Bank AG has agreed to pay $38 million to settle U.S. litigation over allegations it illegally conspired with other banks to fix …

ZEROHEDGE

http://www.zerohedge.com/news/2016-10-17/deutsche-bank-pays-38-million-settle-silver-manipulation-lawsuit

While the amount is tiny for the German bank, now that it is enshrined in case law, it will unleash dozens of similar class action lawsuits, each tweaked a little, and each demanding tens of millions from the gold and silver rigging banks…